- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

The Market Tanked During Trump’s First 100 Days. Buy These 2 Stocks for What Comes Next.

President Donald Trump’s return to office marked the worst start for stocks since President Richard Nixon’s second term in 1973. The S&P 500 Index ($SPX) tumbled 7.9% through April 25, compared to the historical average 2.1% gain for presidents’ first 100 days.

Market volatility surged as investors navigated Trump’s aggressive trade policies. The Cboe Volatility Index ($VIX) hit a five-year high in April, while currency and bond markets also experienced turbulence. The dollar index plummeted 9% - its worst-ever performance for a president’s initial months - suggesting investor skepticism toward U.S. assets.

This sharp decline contrasts with Trump’s first term, in which stocks gained about 5% in the first 100 days. Analysts attribute the difference to the immediate implementation of trade policies this time around.

Here are two stocks you can buy right now to navigate an uncertain macroeconomic environment. These two stocks are both up in the year to date and over the past three months, showcasing their resiliency amid near-term headwinds. Moreover, the two stocks offer dividend yields near 3% in 2025.

Stock #1: WEC Energy Group

Valued at a market cap of $35 billion, WEC Energy (WEC) provides regulated natural gas (NGM25), electricity, and renewable energy services across multiple U.S. regions. It generates power from diverse sources, including coal (LUK25), natural gas, nuclear, wind, and solar. Its infrastructure includes overhead lines, underground cables, gas distribution mains, and natural gas storage capacity. Shares are up 16% in the year to date and up 10% over the past three months.

WEC Energy reported adjusted earnings of $4.88 per share for 2024, up $4.63 per share in 2023. It estimates earnings to range between $5.17 per share and $5.27 per share in 2025 and maintains its long-term EPS growth target of 6.5%.

The company is advancing its balanced generation strategy, with $9.1 billion planned for 4,300 MW of renewables by 2029, alongside critical investments in natural gas. The Paris Solar Park (180 MW) entered service in 2024, with the 225 MW Darian Solar Park expected online later this year. WEC Energy faces increased demands as large companies like Eli Lilly (LLY) grow their footprints in the Midwest.

WEC Energy pays an annual dividend of $3.57, translated to a yield near 3.3%.

Out of the 16 analysts covering WEC stock, four recommend “Strong Buy” and 12 recommend “Hold.” The average target price for the utility stock is $105.32, below the current trading price.

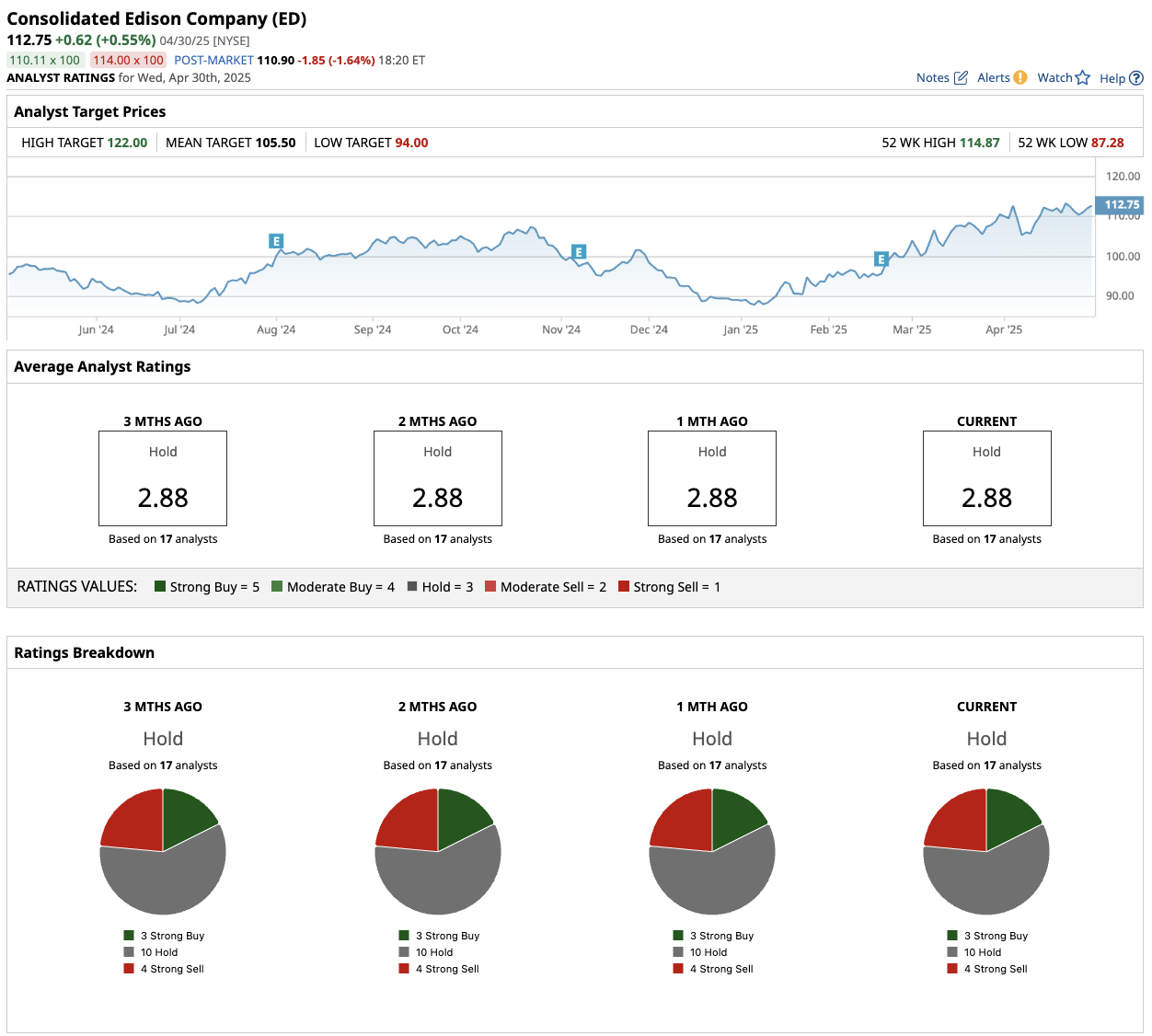

Stock #2: Consolidated Edison

Valued at a market cap of $40 billion, Consolidated Edison (ED) is another large-cap utility giant you should consider owning today. In 2024, Consolidated Edison reported adjusted earnings of $5.40 per share, up from $5.07 per share in 2023. The company’s performance was driven by effective execution of rate plans and ongoing investments in grid infrastructure. ED stock is up 27% in the year to date and up 20.4% in the past three months.

For 2025, ED expects adjusted earnings to be $5.50 to $5.70 per share and forecasts a 6%-7% compound annual growth rate in adjusted earnings over the next five years. This outlook is supported by planned capital investments totaling $38 billion from 2025 to 2029, including $5.12 billion in 2025 and $8.07 billion in 2026.

Consolidated Edison pays an annual dividend of $3.40, yielding 3.01%.

CEO Tim Cawley emphasized ED’s strategy of supporting the adoption of clean energy while delivering reliable electric service. Key initiatives include the construction of substations and transmission lines under the Reliable Clean City program, positioning the company to meet the growing demand for electrification in buildings and transportation.

Consolidated Edison serves New York City and Westchester County with electric, gas, and steam services through its regulated utilities, operating with approximately $15 billion in annual revenues and $71 billion in assets.

Out of the 16 analysts covering ED stock, three recommend “Strong Buy,” 10 recommend “Hold,” and four recommend “Strong Sell.” The average target price for the utility stock is $105.50, below the current trading price of $112.75.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.